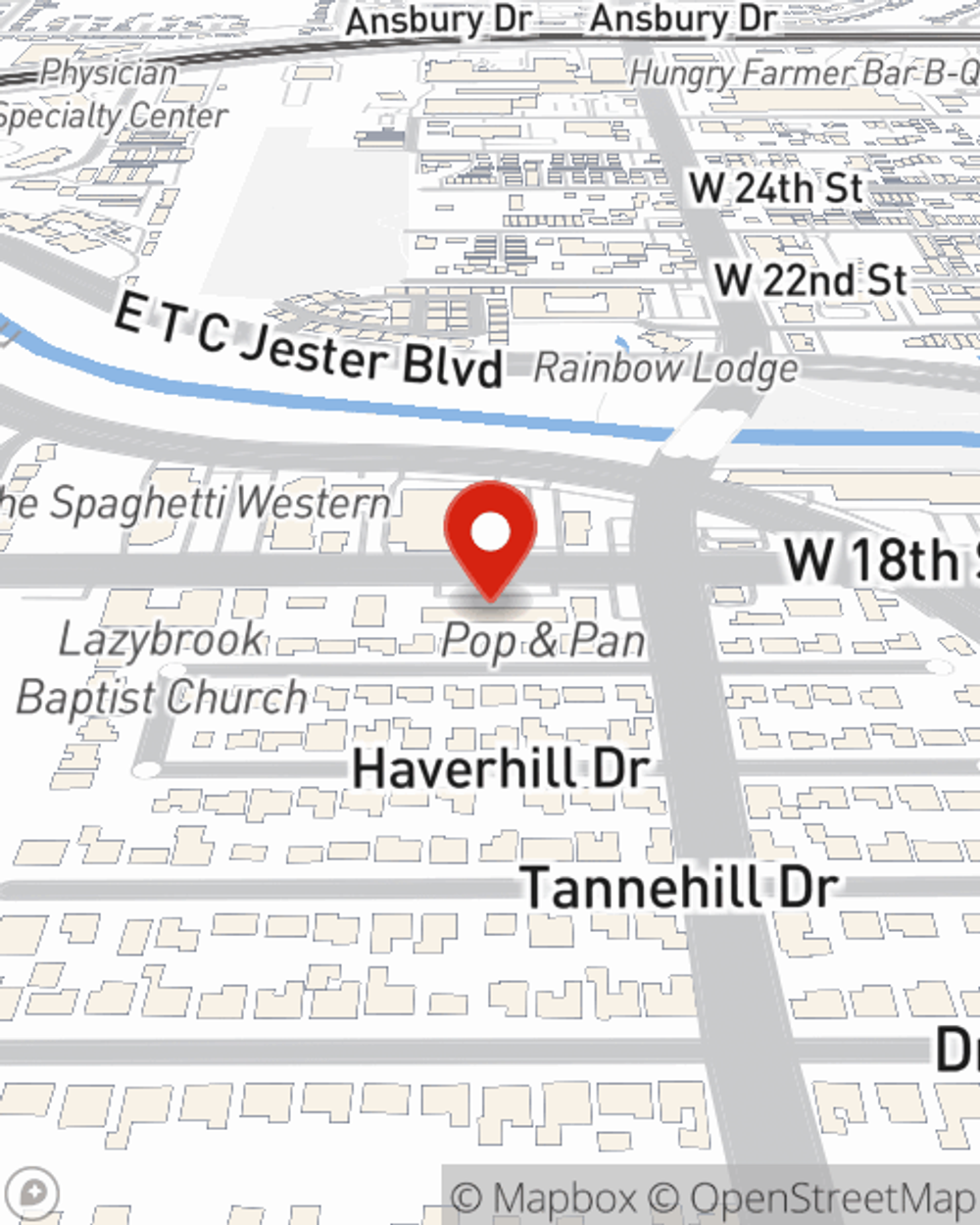

Life Insurance in and around Houston

Insurance that helps life's moments move on

Life happens. Don't wait.

Would you like to create a personalized life quote?

Protect Those You Love Most

There's a common misconception that Life insurance isn't necessary when you're still young, but even if you are young and just starting out in life, now could be the right time to start learning about Life insurance.

Insurance that helps life's moments move on

Life happens. Don't wait.

Put Those Worries To Rest

One of the ideal times to get Life insurance can be when you're just starting out. Whether you decide to go with coverage for a specific time frame level or flexible payments with coverage to last a lifetime or another coverage option, State Farm agent Tim Paul can help you with a policy that's right for you.

As a commited provider of life insurance in Houston, TX, State Farm is committed to protect those you love most. Call State Farm agent Tim Paul today for help with all your life insurance needs.

Have More Questions About Life Insurance?

Call Tim at (713) 862-8806 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Is bundling insurance worth it?

Is bundling insurance worth it?

Bundling insurance, such as auto and home, can be a great way to get discounts, but that’s not all! Discover why bundling makes sense for savings and more.

Whole Life insurance

Whole Life insurance

What is the difference between Ordinary life and Limited-payment life? Read about some common uses for Whole Life Insurance.

Simple Insights®

Is bundling insurance worth it?

Is bundling insurance worth it?

Bundling insurance, such as auto and home, can be a great way to get discounts, but that’s not all! Discover why bundling makes sense for savings and more.

Whole Life insurance

Whole Life insurance

What is the difference between Ordinary life and Limited-payment life? Read about some common uses for Whole Life Insurance.